Applying to KAUST - Your Complete Guide for Masters & Ph.D. Programs (Upcoming Admissions)

Admissions Overview & Key Requirements

The UK’s student loan system has come under renewed scrutiny as concerns grow about affordability and long-term repayment, especially for graduates on Plan 2 loans. Personal finance expert Martin Lewis has criticised the government’s decision to freeze repayment thresholds, calling it “not a moral thing to do”.

According to the UK government, student loans are designed to support access to higher education and are typically divided into two parts:

Most students are eligible for a tuition fee loan, which covers the full annual cost of their course. Current tuition fee levels across the UK are:

The maintenance loan is intended to help with accommodation, food, books and other essential expenses. It is means-tested, meaning the amount a student can receive depends on household income. Additional support may be available for students with disabilities or dependent children.

Students under the age of 25 who have no contact with their parents can apply as estranged students, in which case parental income is not taken into account.

According to research published in May 2024 by the Higher Education Policy Institute, maintenance loans in England typically cover only around half of students’ living costs, with the proportion even lower for those studying in London.

How much can students borrow for living costs?

Maintenance loan amounts vary depending on where students live and study.

For the 2025–26 academic year, undergraduate students in England and Wales will be able to borrow more for day-to-day living costs than in previous years.

For example, students from England living away from home outside London will be eligible for a maximum maintenance loan of £10,544, up from £10,227.

The government has also announced the reintroduction of maintenance grants of up to £1,000 per year for students from lower-income households in England who are studying courses aligned with its Industrial Strategy. These grants will be introduced from 2028, with the list of eligible courses still being finalised.

In other parts of the UK:

How will tuition fees and maintenance loans change?

From 2026, both tuition fees and maintenance loans are expected to rise annually in line with RPIx, an inflation measure based on the Retail Price Index excluding mortgage interest payments.

Based on the rate announced in October 2025, tuition fees could increase by approximately £400 per year, pushing the maximum fee to over £9,900.

The government has said that only universities in England delivering strong outcomes for students will be permitted to charge the maximum fee. Institutions that fall below quality thresholds set by the regulator, the Office for Students, may also face limits on student recruitment.

Source: BBC News

Share

Applying to KAUST - Your Complete Guide for Masters & Ph.D. Programs (Upcoming Admissions)

Admissions Overview & Key Requirements

Registration Opens for SAF 2025: International STEAM Azerbaijan Festival Welcomes Global Youth

The International STEAM Azerbaijan Festival (SAF) has officially opened registration for its 2025 edition!

An mRNA cancer vaccine may offer long-term protection

A small clinical trial suggests the treatment could help keep pancreatic cancer from returning

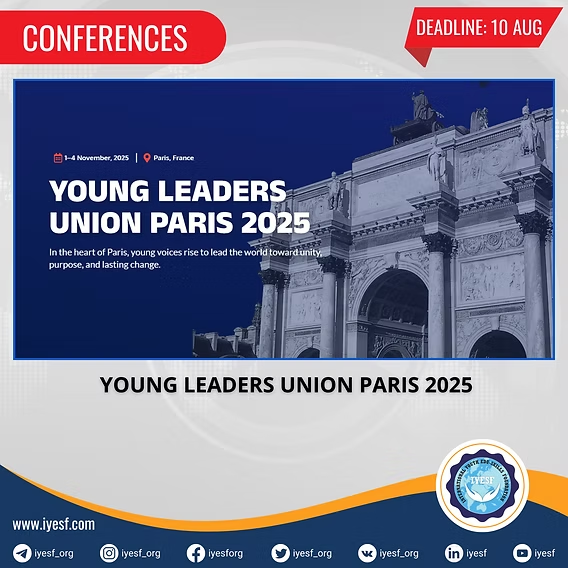

Young Leaders Union Conference 2025 in Paris (Fully Funded)

Join Global Changemakers in Paris! Fully Funded International Conference for Students, Professionals, and Social Leaders from All Nationalities and Fields

Yer yürəsinin daxili nüvəsində struktur dəyişiklikləri aşkar edilib

bu nəzəriyyənin doğru olmadığı məlum olub. Seismik dalğalar vasitəsilə aparılan tədqiqatda daxili nüvənin səthindəki dəyişikliklərə dair qeyri-adi məlumatlar əldə edilib.

Lester B Pearson Scholarship 2026 in Canada (Fully Funded)

Applications are now open for the Lester B Pearson Scholarship 2026 at the University of Toronto!