Registration Opens for SAF 2025: International STEAM Azerbaijan Festival Welcomes Global Youth

The International STEAM Azerbaijan Festival (SAF) has officially opened registration for its 2025 edition!

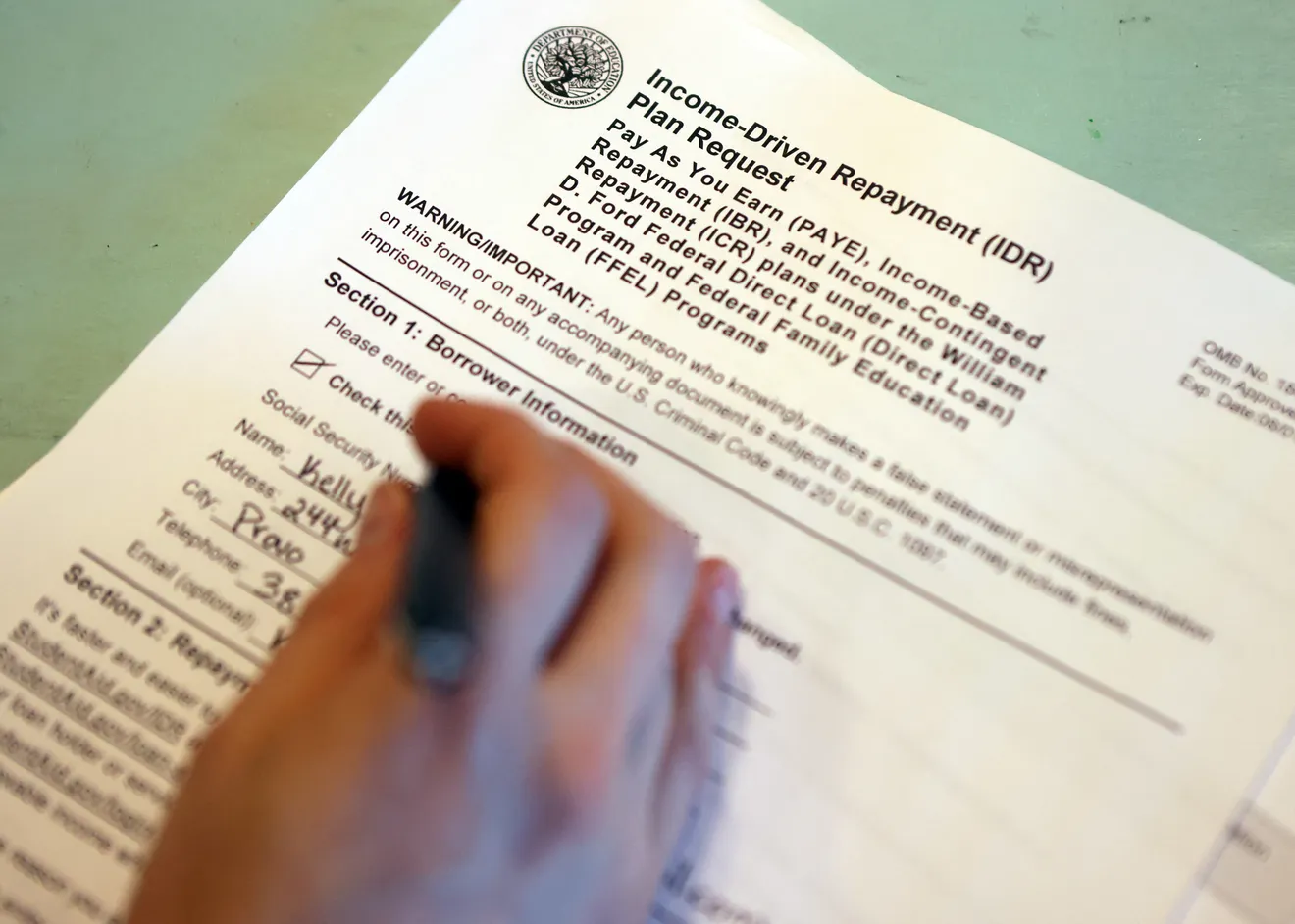

The Trump administration is weighing a controversial plan to sell off portions of the federal government’s $1.6 trillion student loan portfolio to private investors, a move that could reshape the student lending landscape for more than 45 million Americans, Politico reports.

According to multiple people familiar with internal discussions, senior officials at the Education and Treasury departments have been exploring how to transfer “high-performing” segments of the portfolio to private lenders or investment firms. The administration has also reached out to finance industry executives and potential buyers to gauge market interest.

The conversations, which date back several months, come as part of President Donald Trump’s broader goal to shrink the size of the federal government and reduce its direct role in education and lending. Trump has repeatedly vowed to close the Department of Education and move federal loan programs under the Treasury Department, arguing that “the department is not a bank and must return bank functions to an entity equipped to serve America’s students.”

Federal law allows the Education Department to sell student loans, but only if doing so “does not cost taxpayers money.” That requirement presents a significant obstacle.

During Trump’s first term, the department hired outside consultants to analyze the potential value of the loan portfolio. The findings were discouraging: private investors were willing to pay far less for the loans than government accountants had projected. A 2019 McKinsey & Co. study estimated that roughly 45 percent of federal student loans might never be fully repaid.

Because of that gap, any sale could result in the government — and by extension, taxpayers — losing money. “I really don’t see a scenario here where taxpayers come out ahead,” said Preston Cooper, a senior fellow at the American Enterprise Institute. “Private investors wouldn’t pay more than the loans are worth.”

Trump officials argue that the review is still in its early stages. “The administration is committed to analyzing all aspects of the federal student loan portfolio,” a senior official told Politico. “Unlike the previous administration, we are focused on ensuring the long-term health of the portfolio for the benefit of both students and taxpayers.”

The Trump administration has also resumed collections on defaulted student loans for the first time since the COVID-19 pandemic paused repayments in 2020, using programs like the Treasury Offset Program to recover unpaid debt.

If the government ultimately moves forward, borrowers might first notice only a change in where they send payments — similar to when a mortgage is sold to a different bank. The original interest rate, monthly payment, and repayment term would likely remain the same.

But experts warn that federal student loans come with protections and repayment options that private companies may not be required to honor. Borrowers with federal loans can pause payments during hardship, enroll in income-driven repayment plans, or even qualify for forgiveness after public service.

Private lenders cannot replicate all those terms. They also lack the federal government’s powerful collection tools — such as the ability to garnish tax refunds or Social Security benefits without a court order.

Eileen Connor, executive director of the Project on Predatory Student Lending, said the economics of such a sale “only work if borrowers lose out.” She noted that much of the portfolio’s value lies in legal powers that private entities simply don’t have. “It’s important for any potential buyer and for all student loan borrowers to understand that there are certain rights and protections that are part of their loans that can’t be written out because of the sale to a private entity,” she said.

Selling off part of the loan portfolio would fit within Trump’s broader campaign promise to close the Education Department and cut federal spending. Supporters say moving loans to the private market could make the system leaner and reduce administrative costs.

But critics argue it would enrich investors at the expense of both borrowers and taxpayers. Mike Pierce, executive director of Protect Borrowers, a consumer advocacy group, called the idea “a giveaway to Wall Street.”

“Once again, we see that when Wall Street’s demands run against the financial needs of working people, the bankers get what they want,” Pierce said.

Even among conservatives, skepticism remains. Kent Smetters of the Penn Wharton Budget Model said any sale would face a “high hurdle” to prove it doesn’t burden taxpayers. Because private buyers would value the loans lower — and because they can’t collect as aggressively as the government — it’s unclear how such a transaction could meet the law’s cost-free requirement.

For now, administration officials say no decision is imminent. They are expected to continue internal reviews and possibly hire outside firms to determine the loans’ current market value.

Still, the renewed discussions suggest that privatizing federal student debt is back on the table. And for the tens of millions of Americans carrying student loans, that means the next few months could bring new uncertainty over who ultimately owns their debt — and what rights they’ll have if it changes hands.

Share

Registration Opens for SAF 2025: International STEAM Azerbaijan Festival Welcomes Global Youth

The International STEAM Azerbaijan Festival (SAF) has officially opened registration for its 2025 edition!

Applying to KAUST - Your Complete Guide for Masters & Ph.D. Programs (Upcoming Admissions)

Admissions Overview & Key Requirements

Join the Edu-live Internship Program!

Are you passionate about journalism, education, science, as well as global study and development opportunities? Do you want to be part of a dynamic media platform that brings educational and scientific news and stories to life from around the world?

Young Leaders Union Conference 2025 in Paris (Fully Funded)

Join Global Changemakers in Paris! Fully Funded International Conference for Students, Professionals, and Social Leaders from All Nationalities and Fields

An mRNA cancer vaccine may offer long-term protection

A small clinical trial suggests the treatment could help keep pancreatic cancer from returning

Yer yürəsinin daxili nüvəsində struktur dəyişiklikləri aşkar edilib

bu nəzəriyyənin doğru olmadığı məlum olub. Seismik dalğalar vasitəsilə aparılan tədqiqatda daxili nüvənin səthindəki dəyişikliklərə dair qeyri-adi məlumatlar əldə edilib.